What Trump’s win means for FedNow and XRP’s future

Beneath the cryptocurrency market’s optimism that arose from Donald Trump’s re-election and the associated bull run, there is no shortage of confusion about what his re-election will mean for the industry and the economy more broadly.

While there is little doubt that the incoming administration is vocally far more favorable to digital assets than the outgoing one, the exact policy – and the exact effects of the hypothetical policies – remain uncertain.

In this climate, the fate of the Federal Reserve’s FedNow system, a potential U.S. central bank digital currency (CBDC), and Ripple Labs has again come to the forefront.

Picks for you

What will happen to Fed and Ripple under Trump

Something of a double narrative has emerged in November. On the one hand, Donald Trump pledged to prevent the creation of an American digital currency, seemingly adopting the view held among some Republicans that such a development would be part of an enhanced financial surveillance system.

Simultaneously, years-old rumors that Ripple’s XRP and XLM are being considered as the systems that could power the blockchain aspects of FedNow are resurfacing, frequently with the ‘breaking’ qualifier.

These two stories already represent something of a paradox since the wishful thinking that Ripple will expand its government contracts to home turf – and thus likely send XRP ‘to the moon’ – clashes with the pledge that there will be no national digital currencies.

Furthermore, it is worth pointing out that there has been no official source discussing a partnership between the Fed and XRP or XLM in years, and the article that appears to have been the source for the dubious rumor itself seems highly speculative.

Another nail in the coffin of the rehashed news is that the Fed itself clearly distinguishes between FedNow – an instant transfer service for banks and credit unions – and a potential CBDC and other possible digital currencies.

Additionally, while the fate of FedNow under Trump is unclear, it isn’t necessarily uncertain. The service was launched in July 2023, and gutting one of the Federal Reserve’s payment systems is not a logical priority.

Still, given the Trump campaign’s more pro-crypto nature, FedNow may eventually receive a blockchain component. Simultaneously, the government may target it if it becomes a popular talking point for some politicians for some reason.

Can Ripple still benefit from the second Trump administration

As for Ripple and XRP, the fact they are unlikely to benefit from a partnership with the U.S. does not mean they will not benefit from the second Trump administration – in fact, they already are.

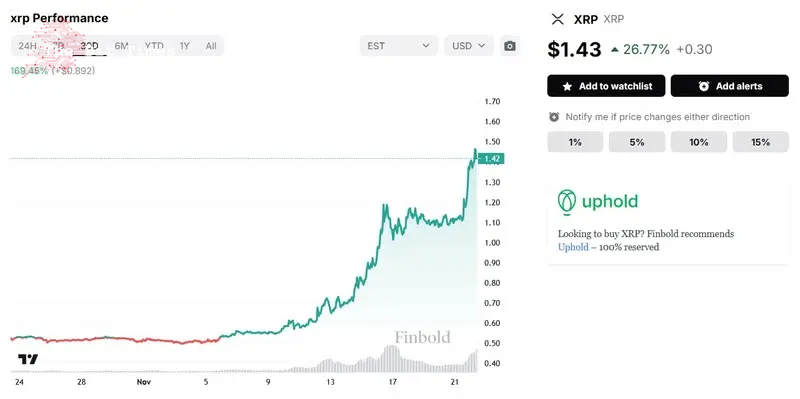

Though the legal battle between Ripple and the Securities and Exchange Commission (SEC) is not over, XRP has managed a massive rally since November 5 and is up 169.45% in the last 30 days to its press time price of $1.43.

The source of this rally was not lost on Ripple’s CEO Brad Garlinghouse who tweeted on November 21 that he is thankful for Gary Gensler’s announced January 20 resignation.

This outlook that with or without a partnership with the Federal Reserve, the coming years will be good for XRP is prevalent across the crypto community. For example, Ali Martinez, a prominent digital assets on-chain analyst on X, opined that Gensler’s departure could propel the token to $2, as reported by Finbold earlier on November 22.

Could the Trump administration backfire on crypto investors?

Finally, it is worth pointing out that all the rhetoric and the expectations – which are, by all accounts, optimistic – could still be a road to nowhere.

While Donald Trump has promised to make the U.S. a cryptocurrency capital, the track records of various actors in the legislative and executive branches of the government – including prominent digital assets advocates – could be described as hypocrisy and maliciousness at worst and incompetence and naivety at best.

Representative Tom Emmer, who in approximately six months went from shielding FTX from an SEC probe to bashing Chair Gensler for not investigating earlier, is the first to come to mind.

While past performance is no guarantee of future success, examples such as the gentleman from Minnesota highlight the underlying uncertainty and warn that bullish rhetoric need not translate into bullish outcomes.

Comments

Post a Comment